What’s Behind the PEO Meaning?

What is a Professional Employer Organization? It’s a service that streamlines HR for businesses by managing essential functions like payroll processing, ensuring employees are paid accurately. They provide access to competitive employee benefits and help companies stay compliant with labor laws, reducing legal risks. With a comprehensive suite of responsibilities and global PEO coverage, this approach enables the client company to focus on its core business operations while cost-effectively handling HR functions.

PEO Definition

A Professional Employer Organization (also known as PEO acronym) acts as a co-employer for its clients while offering a comprehensive suite of HR solutions to help companies manage employee-related administrative functions.

As per a Professional Employer Organization definition, PEO functions as a co-employer taking over the legal share of responsibilities. This way, the PEO model encompasses the responsibility of co-managing a variety of HR functions. Additionally, international Professional Employer Organizations are committed to providing global HR coverage across multiple countries and ensuring compliance with diverse local employment laws and regulations.

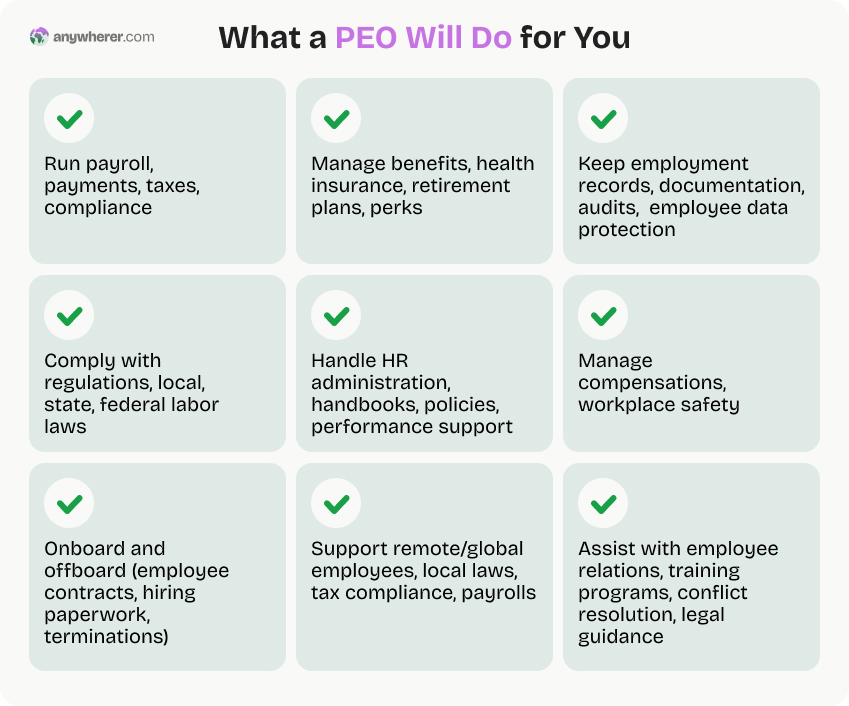

Main Areas of PEO Model

Payroll Processing

Employee Benefits Administration

Compliance Management

Human Resources Support

Risk Management

Recruitment and Staffing

Training and Development

Performance Management

Time and Attendance Tracking

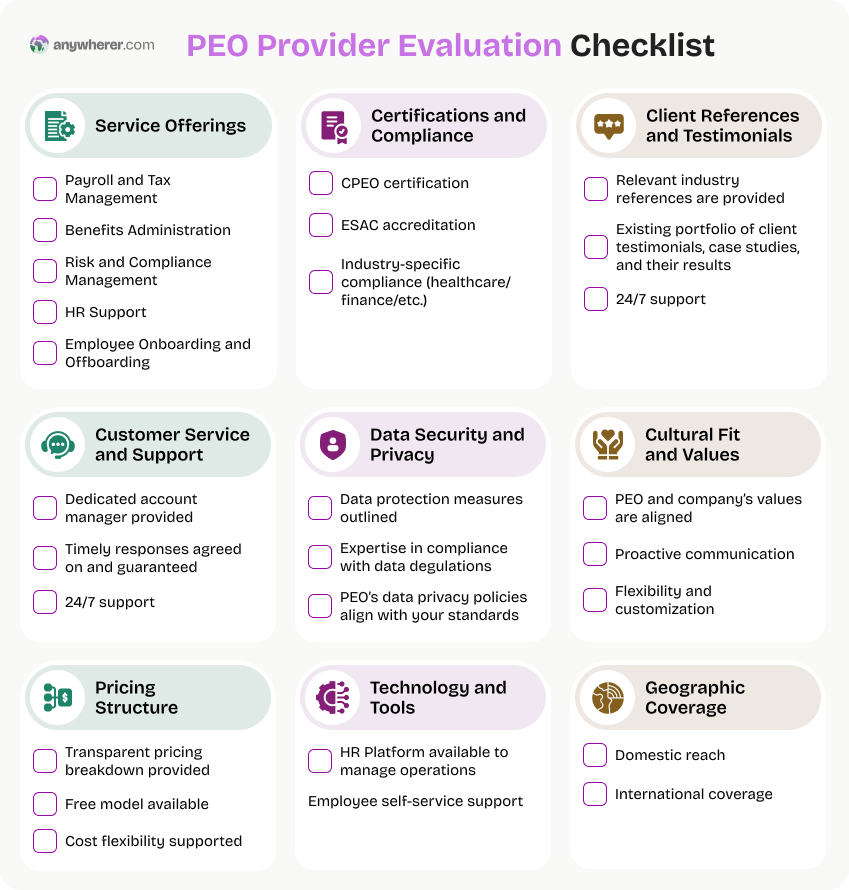

PEOs come in different forms and accreditations. For instance, a CPEO (short for Certified Professional Employer Organization) is a PEO that has received IRS certification, providing additional tax benefits and assurances for compliance. Unlike a standard PEO, a CPEO’s certification ensures the IRS recognizes it as a legitimate co-employer, adding an extra layer of trust and tax advantages for clients.

While exploring PEO meaning, it’s also important to understand EOR meaning (Employer of Record). While both solutions help businesses manage HR, payroll, and compliance, an EOR takes full legal responsibility for employees in international markets, whereas a PEO partners with companies that already have legal entities in place.

PEO Model Essentials: PEO Benefits, Impact & Use Cases

Any decision to choose a PEO partner requires a thorough review of its offerings and potential impact. Let’s examine Professional Employer Organization pros and cons, as well as its range of capabilities, in greater detail.

Keeping the above-mentioned benefits of using a PEO, there are certain areas where PEOs can bring the most impact for businesses. You will benefit from a PEO if:

You look for cost-effective benefits

PEO pool employees from multiple client companies, giving small businesses access to more affordable health insurance, retirement plans, and other benefits typically available only to larger organizations.

Your aim at reduce the administrative burden

By handling time-consuming HR tasks like payroll, benefits administration, and compliance monitoring, PEOs help businesses focus on their core business activities without wasting time on administration. This frees up the companies’ internal resources and fosters strategic improvements and growth.

You lack in-house HR expertise

Many small to mid-sized businesses don’t have a dedicated HR department. PEO for startups fills that gap by providing professional HR support, offering all necessary services to ensure your HR processes run smoothly.

Your business is facing rapid growth

One of the key PEO benefits is flexibility. Whether you’re hiring a few or scaling fast, PEO HR services ensure compliance and smooth onboarding without costly errors.

Your business operates in multiple states or countries

Managing compliance across locations is complex. PEOs simplify it by handling state-specific laws, payroll taxes, and risks, helping you avoid penalties.

You have a diverse employee group

If your workforce includes employees in different states, regions, or with varying employment needs, a PEO partner helps manage this complexity. PEOs can secure lower average healthcare costs, offer flexible benefit plans, and ensure all workers have the coverage they need.

For a deeper understanding of how the PEO model works in practice, check out our detailed TriNet review and how it compares to key TriNet competitors.

Things to Consider Before Opting for Global PEO

While the scope of work and PEO advantages are extensive, this option has its limitations that allow employers to retain control over operational oversight and strategic HR decisions.

Remember: PEO for small business is a co-employer relationship, but you call the shots when it comes to the strategy. Hiring choices, performance management, and building company culture are all the company’s responsibilities that PEOs do not control. Also, while PEOs offer compliance guidance, they do not serve as legal counsel or set pay levels, leaving compensation and conflict resolution to the business itself.

PRO TIP: Ensure double-checking after engaging with a PEO agency as they act as a middleman, it’s important to verify that no mistakes are made. After all, you know your business and employees better than they do, and there may be specific nuances to consider.

Curious how the PEO model compares to other global expansion strategies? Learn the BOOT meaning and explore how Build-Own-Operate-Transfer offers a path to long-term ownership and control.

Like any business relationship, working with a PEO comes with potential challenges. Let’s explore global Professional Employer Organization disadvantages and how to steer clear of them throughout the PEO collaboration.

Unclear pricing

PEOs may offer attractive rates upfront, but hidden fees and complex pricing can make it hard to see exactly what you’re paying for, especially without close review.

How to address:

- Request a detailed cost breakdown during negotiations.

- Consider negotiating service agreements to include specifics about pricing adjustments you can benefit from, such as caps on annual price increases or fixed rates for key services.

Exit costs

Leaving a PEO can be costly, with termination fees and added expenses for taking HR and compliance back in-house. It’s not always a simple switch.

How to address:

- Carefully review the exit clauses and penalties before entering into a contract.

- Plan for contingencies by discussing potential exit strategies with the PEO in case you decide to part ways.

Lack of personal touch

Because a PEO isn’t embedded in your team, employees may feel disconnected, especially when directed to generic hotlines for HR, payroll, or benefits support.

How to address:

- Foster direct communication between employees and your internal HR team for personalized support.

- Familiarize a dedicated PEO representative with your company values.

Limited customization

PEOs often provide a set of standard policies and a boilerplate employee handbook, which may not suit every organization. If your HR and finance teams are well-developed, you might find yourself paying for services you don’t need due to the one-size-fits-all approach. In contrast, HROs offer more flexibility in service selection – if you’re wondering what is HRO, it’s a model where companies outsource specific HR functions rather than a full-service co-employment approach.

How to address:

- Clearly communicate your specific needs and preferences during onboarding

- Request customization options for your specific business case.

Key Practices to Ensure Successful PEO Services Integration

When working with PEO, make sure to follow these practices:

Clarify in utmost detail the worksite agreement you have with the PEO

Ensure you have a clear understanding of the role division between you and the PEO to avoid operational gaps. Since, in most cases, business decisions remain the company’s responsibility, be prepared to stay involved in strategic decisions and integrated into key processes.

Dig into the customer service model

Verify the scope of customer services the PEO is committed to providing. If a dedicated account representative is promised, confirm their accessibility, response time, and support hours. Also, check if they assist both administrators and employees — this will help you gain a clear perspective on future collaboration and processes.

Take advantage of PEO’s HR training

Many PEOs offer consultants and on-demand HR training, guiding on issues of varying complexity. This advantage is worth utilizing, especially as HR laws change nearly every year.

Look for local PEO companies, but consider scalability

While their rates are similar, smaller local PEOs often provide better support and personalized interaction than larger companies, which may outsource services or experience high turnover. A regional PEO may work well initially but could become limiting as your business grows beyond its coverage. Therefore, ensure your PEO can support expansion into other priority regions.

Check certifications

PEO holding CPEO and ESAC certifications indicate they are IRS-approved and meet high standards for financial security, compliance, and operational reliability. This will provide added confidence in its ability to manage clients’ operations accurately and responsibly.

Not sure how to choose a PEO? Use this checklist to evaluate potential PEO providers based on the key factors that matter most to your business:

How Does a PEO Work?

So, with all aspects above considered, how does a Professional Employer Organization work?

The PEO staffing process focuses on co-employment, where both the company and the PEO share responsibilities for managing employees. Here’s an overview of how PEO works, step by step.

| Without PEO | With PEO | |

| Hiring Needs Specification | The company meets internally to discuss hiring needs | Meet with PEO to outline goals and challenges |

| Defining Job Requirements | HR defines job roles and responsibilities | Company collaborates with PEO to define roles |

| Job Posting and Recruitment | Managed by HR | Managed by PEO |

| Candidate Sourcing | HR sources candidates | PEO leverages its network for candidate sourcing |

| Candidate Screening | Managed by HR | Managed by PEO |

| Selection of Candidates | Final selection made by HR and management | Company retains final say but PEO assists |

| Employment Contract Generation | Managed by HR | Managed by PEO |

| Onboarding Process | Managed by HR | Managed by PEO |

| Payroll Setup | Managed by HR | Managed by PEO |

| Compliance Management | Managed by HR | Managed by PEO |

| Benefits Administration | Managed by HR | Managed by PEO |

| Workers’ Compensation Management | Managed by HR | Managed by PEO |

| Ongoing Support | Managed by HR | Managed by PEO |

| Regular Performance Reviews | Managed by HR | Managed by PEO |

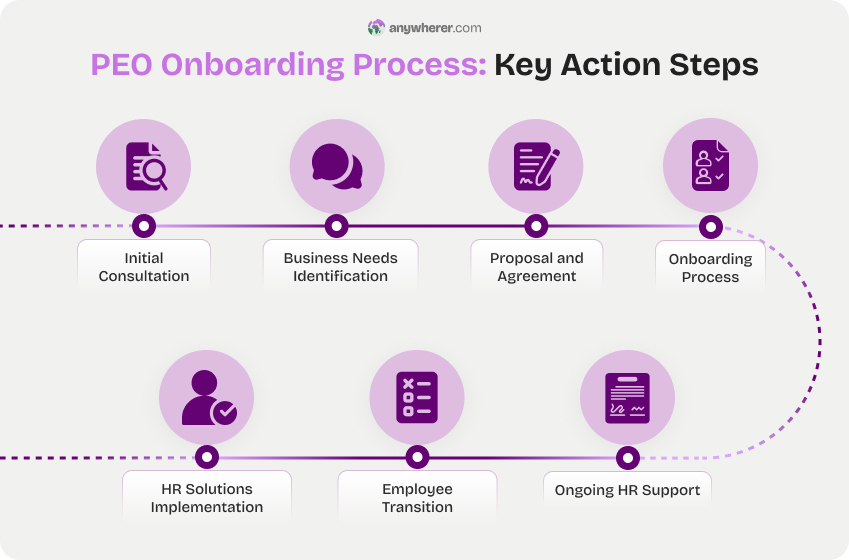

Getting Started with PEO Firm: Step-by-Step Guide

For companies that have already decided to opt for a PEO and are wondering what the initial steps look like, we’ve got you covered.

From assessing your business needs to understanding the roles and responsibilities in the worksite agreement, this guide covers the essential steps to help you make a smooth transition to PEO-supported operations.

- Initial consultation. The company meets with PEO representatives to discuss your business needs, goals, and challenges.

- Business needs identification. The company identifies its current operational gaps by evaluating its HR functions, employee benefits, and compliance status.

- Proposal and agreement. The company reviews the PEO’s proposal, including services offered, pricing structure, and the worksite agreement.

- Onboarding process. The company prepares necessary documentation and employee information for onboarding. At this stage, a dedicated PEO representative is assigned to them.

- HR solutions implementation. PEO benefits administration, PEO payroll processing, and compliance management systems are set up at this stage, along with creating or customizing employee handbooks and HR policies.

- Employee transition. At this step, the company notifies its employees about the PEO partnership. Next on, they conduct a dedicated meeting together to explain the changes and address concerns.

- Ongoing HR support. PEO handles HR consulting, training, employee development resources, and compliance, while the company oversees the process. Whenever needed, regular reviews are scheduled to assess performance, address issues, and make adjustments according to the company’s evolving needs.

FAQs: Why Use a PEO and Other Crucial Questions

What is a Professional Employer Organization?

A professional employer organization (PEO) is a service provider that manages HR tasks like payroll, benefits, and compliance, acting as the legal employer while you handle daily management of your employees.

What is CPEO and how does it differ from PEO?

A CPEO, short for Certified Professional Employer Organization, is a PEO that has been certified by the IRS, meeting stricter standards for financial stability, tax compliance, and regulatory requirements. The CPEO certification offers additional assurance that the organization will manage payroll taxes and other responsibilities in full compliance with federal laws.

What does a Professional Employer Organization do?

A range of services typically include PEO accounting, payroll processing, benefits administration, compliance assistance, risk management, HR consulting, and employee onboarding/offboarding services. By handling these administrative HR tasks, PEOs allow businesses to focus on growth while ensuring legal compliance and providing employees with competitive benefits.

What does managing HR look like before and after partnering with a PEO?

Before using a PEO, HR teams often spend significant time managing compliance, payroll, and employee benefits in-house. For the in-house teams, it means high workloads and potential compliance risks. In contract, after partnering with a PEO, businesses benefit from streamlined HR functions, reduced compliance risks, access to better benefits, and the ability to focus much more time on strategic initiatives.

How much does a PEO cost?

The cost of working with a PEO usually falls into two models: a percentage of payroll or a monthly flat fee per employee. This investment covers payroll, compliance, benefits, and other HR services, often providing valuable cost savings compared to in-house HR management.

How can a Professional Employer Organization company help reduce HR-related risks?

A PEO mitigates HR-related risks by keeping up with legal changes, managing compliance, offering best practices in HR policy. Also, PEO workers compensation and unemployment claims are a part of their service offerings. This expertise reduces the likelihood of non-compliance fines and employment-related liabilities.

Achieve seamless workforce management with PEO model – saving time and resources while staying focused on your core business!

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.