What Does ASO Stand for?

As per an Administrative Services Organization definition, ASOs serve as a resource for handling HR responsibilities while leaving employment liabilities with the client company. With the ASO platform and services, companies retain complete control over their workforce while benefiting from professional assistance across such areas as labor law compliance, administrative work, and HR process optimization. This way, according to the ASO meaning, the model is designed to enhance efficiency by providing customizable support for essential HR functions.

ASO Definition

An Administrative Services Organization (ASO acronym), also known as Administrative Services Only, offers a flexible HR solution for businesses by providing support for employee-related administrative functions, such as payroll, benefits, and compliance, without taking on the role of a co-employer.

Unlike a Professional Employer Organization, an ASO does not act as a co-employer and does not focus on providing global HR coverage. Instead, it provides expertise and tools to help businesses manage their HR responsibilities more efficiently. However, businesses may also opt for a PEO ASO agency that combines both.

ASO Meaning: How It Fits into Modern Business Strategy

Key industry tendencies that redefine the market and strengthen the role of ASO services include.

#1. The rising bar on HR management excellence

INDUSTRY INSIGHT

Recent research states that 80% of CEOs feel pressured to better prioritize human sustainability, a metric incorporating employees’ physical, mental, financial, and social well-being.

With an increasing emphasis on employee satisfaction metrics, a pressing need for improvement has emerged, as only about 1 in 3 workers report that their human sustainability metrics improved over the past year.

Considering this, ASOs can be a driving force for improvement. A strategic ASO provider can alleviate administrative burdens and offer strategic HR support. This way, ASOs help businesses boost employee satisfaction and enhance retention.

#2. Increased adoption by small and mid-sized businesses

INDUSTRY INSIGHT

35% of businesses with fewer than 1,000 employees outsource one or more HR functions.

The HR outsourcing industry, including ASOs, is gaining momentum, with small and mid-sized businesses contributing significantly to this growth. Many of them are turning to ASOs and for a good reason.,

Having limited resources and growing complexity in HR tasks, small and mid-sized businesses face unique challenges in maintaining operational efficiency and employee satisfaction. Understanding the ASO meaning business is key here – ASOs play a vital role in alleviating these challenges for businesses, regardless of their size.

#3. Expanding value beyond cost efficiency

INDUSTRY INSIGHT

While 32.2% of businesses outsource tasks primarily to reduce costs, 20% do so to gain access to innovation, and 15.4% focus on achieving quality improvement.

Cost efficiency is undoubtedly an essential factor driving businesses to opt for ASO services. However, the impact of ASOs extends far beyond cost savings, featuring access to innovation and improvements in quality, agility, and speed to market, to name a few.

Main Areas of ASO

Payroll Management

Benefits and Tax Administration

HR Compliance Support

Employee Records Management

Workers’ Compensation Administration

Recruitment and Onboarding Support

Risk Management and Support

HR Technology Solutions

Customizable HR Services

ASO Model vs Traditional Insurance: What’s the Difference?

Speaking of ASO pros and cons, an Administrative Services Organization approach is considered a more flexible and transparent alternative to traditional insurance. Here are the key differences in ASO insurance vs fully insured plans:

- Flexibility. Unlike fully insured plans, ASOs let businesses tailor benefits, modify coverage, and scale services to align with evolving needs.

- Cost Control. In contrast to inflated premiums in fully insured plans, ASO benefits include cost transparency by self-funding claims, allowing businesses to reduce expenses and retain unused reserves.

- Customization. Unlike standardized insurance plans, an ASO enables personalized benefits within its Administrative Services Only plan — for example, with administrative services only dental insurance, employers can design coverage options that align with employee preferences and company budgets.

| Aspect | ASO | Traditional Insurance |

| Risk Management | Employer assumes the financial risk for claims | The insurer assumes the financial risk |

| Plan Customization | High, tailored to the organization’s needs | Limited, commonly standardized plans by insurer |

| Cost Transparency | Clear view of claims and administrative costs | Premiums cover claims, admin, and profit |

| Cash Flow | Pay claims as they occur (self-funded model) | Fixed monthly premium payments |

| Administrative Responsibility | Outsourced to ASO for claims processing, compliance, and reporting | Fully managed by the insurer |

| Compliance | ASO assists with regulatory compliance | Insurer ensures compliance |

| Scalability | Scalable for growing businesses | Limited flexibility with growth |

| Cost Variability | Costs fluctuate based on claims experience | Fixed costs regardless of claims |

| Flexibility | Employee benefits can be customizable based on specific needs | Standardized benefits across all plans |

Who Needs ASO?

ASO services are highly adaptable solutions for businesses of all sizes and diverse needs. Let’s explore specific use cases, delving into their unique business challenges and the ways ASOs can provide solutions to address them.

ASO for Startups

ASOs can be highly beneficial for startups with limited lean teams and thus struggle to handle HR functions effectively. To address this challenge, ASO services provide an affordable and scalable solution. Thanks to them, startups can access professional HR and thus focus on innovation and business growth while maintaining robust systems for compliance, payroll, and employee support.

Major benefits for startups:

- Affordable HR solutions

- Access to professional HR expertise

- Scalable systems for rapid growth

- Foundation for compliance and employee support

ASO In Action: Use Case for Startups

Industry: Tech Startup

Headquarter: US

Company size: 20 employees

CHALLENGES:

- Limited HR resources and funds for HR infrastructure

- Payroll and compliance complexities for remote employees

- Rapidly changing business needs requiring HR flexibility

SOLUTIONS PROVIDED BY ASO:

- Automated payroll and compliance with state labor laws

- Expert compliance support and guidance on legal requirements

- Centralized employee records

- Access to affordable group health insurance and other

- Opportunity for ASO scaling with the startup’s growth

ASO for Mid-Sized Businesses

Balancing growth with operational efficiency is a real challenge for businesses. To address this, ASO services provide these companies cost-effective solutions for managing HR tasks. By outsourcing these administrative functions, mid-sized businesses can free up internal resources to focus on strategic initiatives like market expansion and talent development.

Key benefits for mid-sized businesses:

- Cost-efficient HR through ASO management services

- Customizable employee benefits

- Access to professional HR expertise

- Scalable solutions for growth

ASO In Action: Use Case for Mid-Sized Businesses

Industry: Retail Chain

Headquarter: UK

Company size: 150 employees

CHALLENGES:

- Limited resources for in-house HR

- Inconsistent payroll processes across 20+ locations

- Need for tailored employee benefit options

- Scaling complexities due to labor law requirements

SOLUTIONS PROVIDED BY ASO:

- Unified payroll platform with time tracking

- Standardized benefits enrollment with flexible and customizable benefit plans

- Expert guidance ensuring compliance

- ASO scales alongside the business

ASO for Enterprises

Large enterprises often manage complex HR functions across multiple locations and jurisdictions, requiring significant resources and expertise to ensure consistency and compliance. With ASO HR outsourcing, enterprises can reduce administrative burdens, improve cost transparency, and focus on strategic goals – for example, global expansion or workforce optimization.

Benefits for enterprises:

- Centralized HR management across multiple locations

- Advanced tools for managing large-scale operations

- Enhanced compliance with complex regulations

- Reduced administrative overhead

ASO In Action: Use Case for Enterprises

Industry: Tech Startup

Headquarter: Canada

Company size: 1,000 employees

CHALLENGES:

- Managing HR across multiple locations

- High overhead for managing HR functions, including seasonal workforce management during peak periods

- Need for cost control and compliance

- Scaling HR systems for international growth without full clarity on HR spending

SOLUTIONS PROVIDED BY ASO:

- Access to advanced HR tools and centralized processes

- Expert support for multi-jurisdictional laws

- Streamlined and outsourced administrative tasks

- Transparent reporting and cost control

- Scalable and adaptable solutions

The ASO model focuses on outsourcing administrative HR functions while keeping employment responsibilities in-house. Understanding related concepts like RPO meaning (Recruitment Process Outsourcing) is essential, as RPO providers manage the hiring process externally, helping businesses find top talent. Similarly, knowing ITES meaning (Information Technology Enabled Services) can clarify how outsourced IT-driven processes support business operations efficiently.

Potential Risks Associated with ASO Company

While an ASO provider undoubtedly has a significant impact on businesses, they may also come with financial risks. Understanding the potential savings and challenges associated with ASOs is essential for making informed decisions.

Unpredictable healthcare costs. ASOs transfer the responsibility of paying claims directly to employers, which means healthcare costs can fluctuate significantly, especially in high-claim years.

Potential ways to solve it:

- Set aside sufficient financial reserves to cover potential high-claim periods.

- Analyze historical claims data to forecast future expenses more accurately.

- Secure stop-loss coverage to limit liability for individual and aggregate high-cost claims.

Administrative complexity. Leveraging ASO payroll, benefits, and compliance without dedicated HR expertise to proactively cooperate with an ASO may be challenging. The financial risks of such administrative complexity include additional ASO fees, compliance penalties, underutilized resources, and transition costs.

Potential ways to solve it:

- Partner with a reliable provider with proven expertise and a track record.

- Leverage HR platforms that simplify processes and reduce manual work.

- Opt for end-to-end administrative support to eliminate inefficiencies comprehensively.

Legal and compliance challenges. Employers bear the responsibility for adhering to local, state, and federal regulations, and failure to comply can result in penalties. This can result in penalties ranging from significant fines, legal fees, and increased operational costs to rectifying non-compliance issues.

Potential ways to solve it:

- Leverage ASO compliance expertise to stay updated on changing regulations.

- Conduct regular audits to efficiently identify and address compliance gaps.

- Provide compliance training to key stakeholders for better adherence to regulations.

Limited access to provider discounts. A self-funded Administrative Services Only plan may lack access to the same network discounts as fully insured plans, leading to higher claims costs.

Ways to address the challenge:

- Choose ASOs that have strong network relationships to secure competitive rates.

- Advocate for better rates with key providers within your network.

- Offer incentives for employees to select cost-effective treatment options.

What to Know Before Partnering with ASO Agency

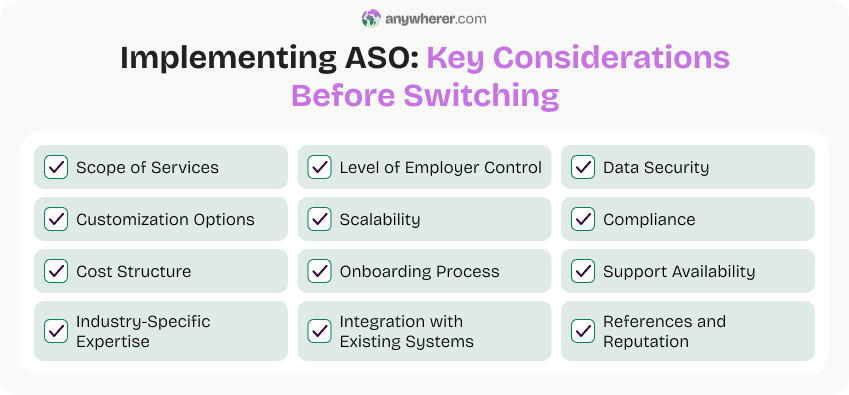

When switching to an ASO, there are several aspects to consider, from the scope of services to data security to scalability and more. See the image below to view the list of must-need considerations:

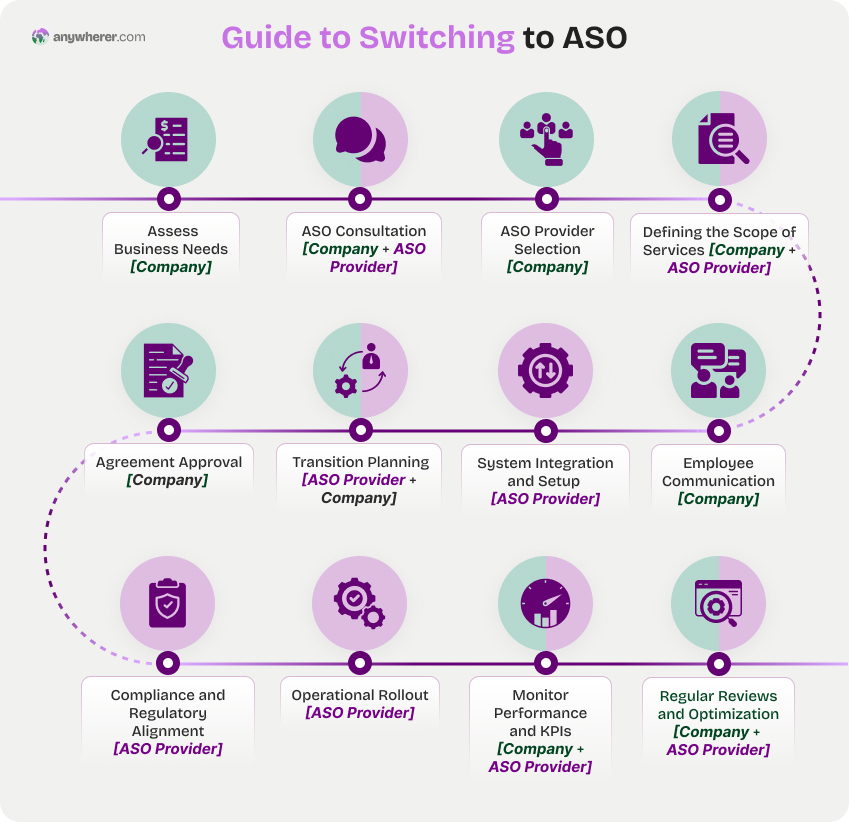

Businesses require careful planning and seamless execution to make a change in favor of ASO. So how does ASO work with the company from day one of their cooperation? See a detailed step-by-step process for onboarding with an ASO:

- Assess business needs. The company evaluates its current HR and administrative challenges and identifies top priority areas where ASO support is needed.

- ASO consultation. The company consults with potential ASO providers to discuss specific requirements, service offerings, and how the ASO can address their business needs.

- ASO provider selection. The company compares ASO providers based on expertise, technology platforms, and costs, selecting the one that best aligns with its goals.

- Defining the scope of services. Together, the company and ASO provider outline specific HR functions the ASO will manage.

- Negotiate and sign the ASO agreement. The company finalizes the ASO partnership by agreeing on service levels, responsibilities, ASO pricing, and contract terms.

- Transition planning. The ASO provider and the company work side-by-side to create a detailed transition plan featuring timelines, responsibilities, communication strategies, and other essentials.

- System integration and setup. The ASO integrates its systems with its existing HR platforms for seamless data flow and operational efficiency.

- Employee communication. The company informs employees about the changes, explains how the ASO will benefit them and provides support for any questions or concerns.

- Compliance and regulatory alignment. The ASO ensures all HR processes comply with local, state, and federal regulations to reduce risks and avoid penalties.

- Operational rollout. The ASO begins managing agreed-upon HR tasks, such as payroll, benefits administration, and compliance tracking.

- Monitor performance and KPIs. The company and ASO provider set and monitor key performance indicators to measure the effectiveness of the ASO services.

- Regular reviews and optimization. The ASO conducts regular reviews with the company to assess service performance and suggest improvements to meet evolving business needs.

ASO Consulting: Unlocking Expertise for a Seamless Transition

As mentioned above, choosing and onboarding with an ASO provider can be a complex and challenging process — hence, it’s where ASO consulting providers step in.

ASO consulting refers to professional services provided by experts who assist businesses in evaluating, selecting, and implementing ASO services, with the core goal of maximizing benefits while minimizing disruptions to existing HR operations.

Explore the range of services commonly offered through ASO consulting:

Key ASO Consulting Services

Vendor Selection

Custom Service Design

Compliance Support

Claims Auditing

Cost Optimization

Performance Monitoring

Vendor Selection

An ASO consultant can assist businesses throughout the end-to-end vendor selection process. They manage RFPs, assess proposals, and ensure that chosen vendors provide optimal services for cost and performance.

Services offered include:

- Evaluating potential vendors for HR and administrative functions.

- Assessing vendor capabilities and service offerings

- Negotiating contracts and service-level agreements.

- Aligning vendor selection with business goals and budget.

Custom Service Design

ASOs collaborate with employers to design an ASO health plan and other benefit packages that attract and retain talent. They conduct market analysis, create detailed proposals, and ensure the plans meet budgetary and regulatory criteria.

Services offered include:

- Designing tailored benefits packages and compensation structures.

- Benchmarking plans against industry standards.

- Aligning plans with company goals and employee needs.

- Reviewing plans for compliance with legal requirements.

Compliance Support

ASOs provide ongoing compliance support, ensuring all HR processes align with legal requirements. They mitigate risks by proactively addressing regulatory updates and conducting regular audits.

Services offered include:

- Monitoring local, state, and federal labor law changes.

- Conducting compliance audits and risk assessments.

- Ensuring payroll, benefits, and contracts comply with regulations.

- Guiding legal best practices.

Claims Auditing and Cost Optimization

While taking over claims auditing proceess, ASOs help businesses identify inaccuracies that may inflate costs. Besides, with ASO claims management, businesses gain valuable and actionable insights that help optimize benefits spending.

Services offered include:

- Auditing employee benefits claims for accuracy and eligibility.

- Identifying discrepancies and resolving errors.

- Providing detailed reports for cost management.

Do You Need ASO Consulting?

- Do you need help selecting vendors for payroll, benefits, or compliance services?

- Are you struggling to ensure compliance with local, state, or federal labor laws?

- Do you find it challenging to manage employee benefits and compensation plans?

- Are you looking to optimize HR-related costs without sacrificing service quality?

- Do you require assistance with onboarding or offboarding processes to improve efficiency?

- Are you concerned about potential compliance risks and legal penalties?

- Do you need to streamline administrative HR tasks like payroll processing and benefits administration?

- Is your business experiencing rapid growth and needs scalable HR support?

Final Thoughts: Is ASO Model Right for Your Business?

With the rising complexity of HR tasks, ASOs have proved themselves as strategic partners for businesses of all sizes.

If you are aiming to understand whether ASO services are right for you, start by analyzing your specific HR challenges and goals. If you’re struggling with benefits administration, compliance with labor laws, or other time-consuming administrative tasks, you could benefit from ASO’s cost optimization and customized HR solutions. For companies focused on streamlining their recruitment efforts, pairing ASO services with Recruitment Process Outsourcing (RPO) can enhance hiring efficiency and ensure access to top talent.

FAQs About ASO Services Expert Offerings

What is ASO and how does it differ from fully insured health plans?

So what is ASO? ASO plans are self-funded arrangements where the employer pays for claims as they occur, whereas fully insured plans involve paying a fixed premium to an insurance company that assumes the risk for claims. This way, Administrative Services Only health insurance plans offer greater flexibility and potential cost savings. In the meantime, opting for a self funded ASO may come with more financial risk, which however can be mitigated through tools like stop-loss insurance.

Who is the ideal candidate for ASO plans?

ASO plans are ideal for businesses with a predictable claims history, a desire for greater control over healthcare spending, and sufficient financial resources to handle claim variability. They are well-suited for mid-sized to large companies but can also benefit smaller.

Is ASO only suitable for large companies?

No, ASO plans are scalable and can benefit businesses of all sizes. Small and mid-sized companies with consistent claims data and a willingness to manage risks can also successfully adopt ASO plans to optimize their healthcare costs.

How does ASO impact employees’ benefits experience?

ASO plans can enhance employees’ benefits experience by offering more customizable options tailored to their needs, quicker claim resolutions through TPAs, and access to wellness programs. However, the benefits depend on how effectively the employer designs and communicates the plan.

How do ASO providers charge for their services?

ASO providers typically charge a flat monthly fee per employee or a percentage of total payroll.

The pricing can vary based on the range of administrative services offered, such as HR support, payroll processing, benefits administration, and compliance assistance.

What’s the role of an ASO in healthcare?

ASOs in the healthcare sector can streamline payroll for healthcare professionals and help them manage complex benefit structures. Besides, they also help healthcare organizations improve recruitment processes, maintain workforce satisfaction, and adhere to industry-specific compliance with regulations like HIPAA.

Who is responsible for claim payments in an ASO funding arrangement?

In an ASO funding model, the employer is responsible for paying employee claims. The ASO manages the administrative tasks, such as claim processing and reporting, ensuring a streamlined operation.

Discover how you can simplify, optimize, and grow your HR operations with ASO!

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.