Introduction to the Employer of Record Model and EOR Costs

The world is more interconnected than ever, and businesses increasingly operate across borders and feature globally distributed teams. The access to a global talent pool and increased flexibility are compelling advantages of global hiring indeed. However, it also introduces added complexities: navigating diverse legal frameworks, managing time zone differences, and addressing cultural variations are a few of them. To address these complexities, businesses often partner with an Employer of Record (EOR).

EOR Definition

Employer of Record is a solution that enables companies to legally hire employees in a country where they do not have a physical presence or registered entity. Acting as the legal employer on behalf of the company, EOR handles a variety of tasks, from compliance to payroll to taxes and beyond.

With the aim to simplify the hiring and management of employees worldwide, the EOR model allows businesses to focus on core operations — all while ensuring that employment practices adhere to regional regulations.

By leveraging an EOR, companies get essential assistance with:

- Expanding into new markets efficiently.

- Mitigating risks associated with international employment.

- Streamlining the management of a global workforce.

- Accessing cost-effective talent worldwide.

- Streamlining global payroll, employee onboarding, benefits administration, and other contractor management operations.

- Simplifying compliance with regional regulations.

- Alleviating a substantial part of the HR burden from the internal team.

- Achieving scalability with ease, regardless of the country.

Undoubtedly, cost efficiency is another significant area of impact. EORs help reduce overhead by handling payroll, benefits administration, and tax compliance, often at a fraction of the cost required to build and maintain in-house HR infrastructure. Some notable use cases of businesses that partnered up with some leading EOR providers include:

- Leya achieved savings of over $120,000 by avoiding entity setup costs thanks to Deel EOR platform.

- Crate reduced annual spending by $1,260 for every UK-based employee with Rippling EOR.

- Kinsta lowered its global employment expenditure by $29,000 annually thanks to Oyster EOR services.

- Axero Solutions claims to save $1M annually thanks to Multiplier global solutions.

- Repsol achieved savings of $3.7 million in onboarding expenses thanks to the optimized workflows of Globalization Partners.

Besides the cost savings, businesses using the services of EOR providers reported the following business impact:

- Lightforce achieved 6 times faster payroll processing with Rippling.

- Strada using G-P’s services reduced its employee onboarding time by 80%.

- Paperform saves 100+ days of HR costs yearly by leveraging Deel EOR solutions.

- Juno gained the ability to hire 3-4 employees within a single day using Oyster EOR services.

- Weaviate grew its workforce by 120% thanks to Remote EOR solutions.

Factors Influencing Employer of Record Costs

Cost considerations surely remain a critical factor in EOR services assessment. While EOR solutions offer substantial savings in setup and compliance fees, their efficiency depends on proper application and alignment with the organization’s needs and growth strategy.

Considering this, EOR pricing depends on various factors. For example, comprehensive services for full-time employees in developed countries with complex compliance requirements tend to be more expensive, whereas basic services for contractors in countries with simpler regulations are often more budget-friendly. Let’s explore key considerations and the nuances of price variations in detail.

Scope of services

Commonly, the broader the range of services, the higher the associated costs. For example, basic packages that include only payroll processing and tax compliance are generally more affordable.

However, it needs to be noted that comprehensive service packages, while higher in cost, deliver significant benefits for businesses in terms of operational efficiency and time savings — handling end-to-end processes of payroll, compliance, benefits administration, onboarding, employee support, and others.

Potential Scopes of EOR Services

Basic EOR Services Package

- Payroll Processing

- Tax Compliance

- Employment Contracts Management

- Benefits and Social Contributions

- Payroll and Tax Recordkeeping

- Employee Classification

- Local Compliance Management

Advanced Package

- Payroll Processing

- Tax Compliance

- Employment Contracts Management

- Benefits and Social Contributions

- Payroll and Tax Recordkeeping

- Employee Classification

- Local Compliance Management

- Onboarding Support

- Ongoing HR Support Services

- Termination Compliance

- Work Visa and Permit Assistance

- Global Mobility Services

- Performance and Development Tracking

- Global Device and IT Management

Engagement type

Full-time employees often require more comprehensive benefits and compliance management than part-time or contract workers, impacting costs.

Additionally, the type of contract and benefits required can influence the total cost: for instance, lower EOR price is commonly associated with contractors, since they require less.

Number of employees

Many EOR providers offer discounts for larger teams. Besides, some EOR providers may offer tiered pricing, where the per-employee fee decreases as the number of employees being managed grows. Such strategies allow EOR providers to cater to a variety of business sizes, from startups with a handful of employees to multinational corporations:

Considering this, comparatively higher costs might occur when managing a few employees (e.g., 1–5 employees) whilst using full service for limited hires, and fixed fees per employee.

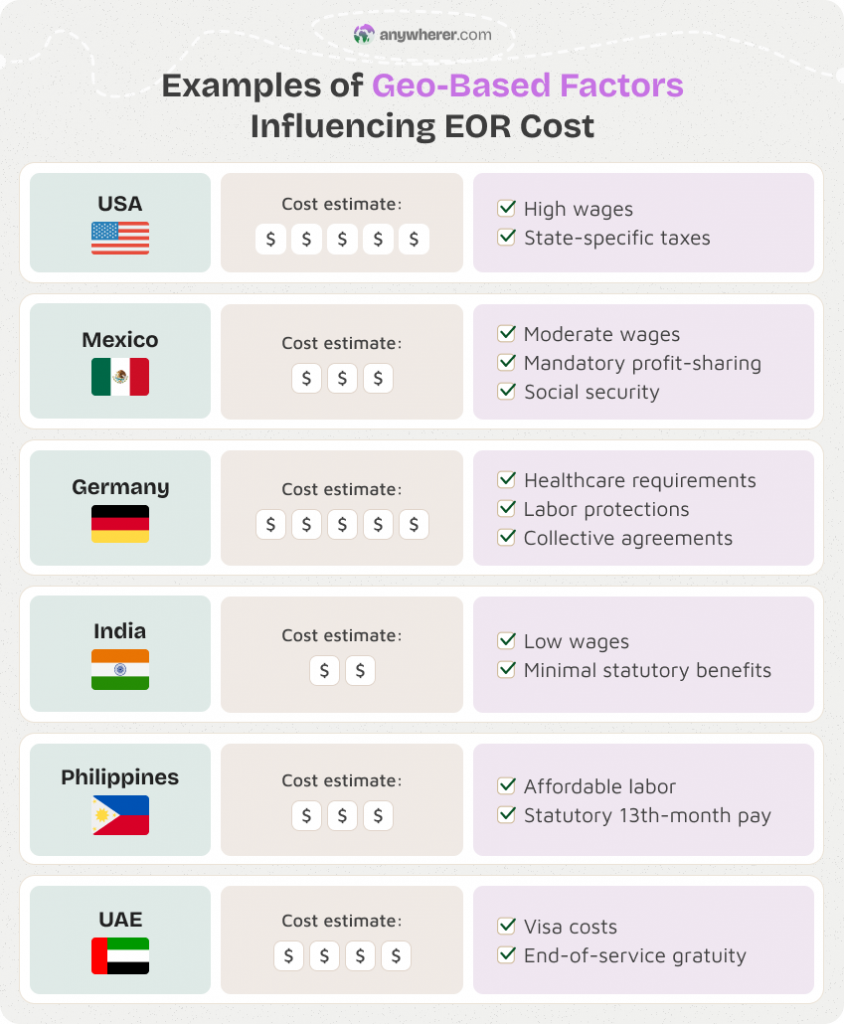

Geographic location

EOR prices and administrative fees vary depending on the country where employees are hired, as each location has its own labor laws, tax rates, and compliance requirements. Hiring in regions with complex legal frameworks or higher wages typically increases EOR expenses.

For example:

- Higher expenses may arise in developed countries like the US, UK, and Germany due to higher wages, complex compliance requirements, and extensive mandatory social benefits.

- Lower cost may be associated with services for emerging markets like India or the Philippines, due to lower wages and basic compliance requirements.

EOR Costs: What Else Should You Factor In?

Apart from the above-mentioned factors, other factors influencing the total cost may include:

- Duration of engagement — long-term partnerships often qualify for lower rates compared to short-term or project-specific arrangements.

- Technology robustness — more advanced EOR platforms with integrated HR, payroll, and compliance tools may be more expensive.

- Level of customization — tailored solutions like industry-specific compliance, advanced analytics, or employee wellness programs can increase the total cost of Employer of Record services.

- Provider expertise — established and premium providers may charge more compared to smaller, local EORs.

Ultimately, it needs to be noted that a higher EOR price may translate to greater value for money. Therefore, businesses should strategically balance expenses with the offerings provided by the EOR.

Factors That Impact EOR Cost

Lower EOR Сosts

- Emerging markets with lower wages

- Long-term, stable partnerships

- Basic payroll and compliance

- Large teams with volume discounts

- EOR platforms with basic functionality

- Smaller, local providers

Higher EOR Сosts

- Focus on developed countries with high wages

- Comprehensive service packages

- Tailored compliance

- Highly custom benefit packages

- Premium, experienced providers

- Industries with strict compliance

Common Employer of Record Pricing Models

So how much do Employer of Record services cost? Well, EOR providers employ various pricing models, thus catering to the needs of businesses of different sizes and requirements. By understanding these structures, businesses can more easily choose the best-fit provider for their workforce management. Let’s review them.

Flat Fees

Example: $1,000 per month for total payroll and compliance services.

The flat fee pricing model implies a fixed amount charged for a specific set of services, regardless of the number of employees or the scope of the engagement.

Per-Employee-Per-Month (PEPM)

Example: $500 per employee per month for payroll, benefits administration, and compliance.

The PEPM pricing model means a recurring EOR fee charged for each employee under the EOR’s management.

Tiered Pricing

Example: $600 per employee for 1–10 employees per month, $500 for 11–50 employees, and $400 for 51+ employees monthly.

This is a pricing model where an EOR service fee decreases as the number of employees increases, offering volume discounts for larger teams.

Pay-As-You-Go

Example: $200 per employee for one-off compliance tasks or payroll processing.

Based on this pricing model, EOR providers charge based on the specific services used or the duration of the engagement.

Annual Pricing

Example: $7,000 annually per employee for a full suite of EOR services.

Annual pricing implies a yearly fee for managing a set number of employees or providing services, often with upfront payments.

Custom Pricing

Example: a pre-agreed price for a bespoke solution with bundled services tailored to specific business needs.

With a custom pricing model, businesses can get a tailored pricing structure designed to meet the unique needs of a business.

EOR Pricing Models for Different Business Sizes

While businesses of any size can choose from various pricing models, some may align with their needs slightly more effectively than others.

For example, many small businesses, when considering EOR solutions, often face budget constraints and limited resources. This makes predictable and simple pricing essential — in which case, Flat Fees, PEPM, or Pay-As-You-Go models can be the most suitable pricing models.

Popular EOR Pricing Models for Small Businesses

Flat Fees

- Predictable costs

- Simple pricing structure

- Avoided cost-tracking complexity

PEPM

- Scales proportionally

- Pricing transparency

- Easy to calculate cost

Pay-As-You-Go

- Flexibility for seasonal hiring

- Ideal for project-based hires

- Avoided fees for unused services

As for medium-sized businesses, they can benefit the most from the combination of scalable and cost-efficient EOR pricing. In this case, the choice might fall between PEPM, tiered, and annual pricing. To address scalability, PEPM offers predictable costs as teams grow, Tiered Pricing reduces EOR fees with volume discounts for expanding workforces, while the Annual Pricing model ensures financial stability with upfront savings, ideal for stable, long-term operations.

Popular EOR Pricing Models for Medium Businesses

PEPM

- Predictable costs

- Scalable pricing

- Simplified cost calculations

Tiered Pricing

- Volume discounts reducing per-employee price

- Flexibility for growing businesses

Annual Pricing

- Predictable expenses long term

- Discounts for upfront payment

- Simple financial planning

Large enterprises, in turn, require cost-effective, scalable solutions for global teams. This aspect can be addressed with Tiered Pricing, providing significant savings for large workforces — or, alternatively, an Annual Pricing model that simplifies long-term budgeting while offering upfront discounts. Additionally, although potentially higher in total cost, the Custom Pricing model can ensure a highly tailored approach able to address complex business needs or industry-specific requirements.

Popular EOR Pricing Models for Large Enterprises

Tiered Pricing

- Significant cost savings for managing large teams

- Flexible for scaling

Custom Pricing

- Highly tailored to specific business needs

- Ideal for complex compliance or custom features

Annual Pricing

- Predictable costs

- Discount for upfront payments

- Simplified long-term budgeting

EOR Pricing of Top EOR Providers

EOR platforms’ pricing can vary significantly based on multiple factors: services offered, geographic coverage, compliance expertise, and additional support provided.

Besides, the EOR price differences often reflect the provider’s value proposition. For instance, premium providers might charge higher but offer more advanced solutions, while budget-friendly options may provide essential services but with limited scalability or customer support.

Understanding these nuances is key to selecting the right EOR partner that aligns with your company’s needs and budget. Let’s review the prices of the most popular EOR solutions in the EOR calculator table displayed below.

Pricing Comparison of

20 Leading EOR Providers

Top20 EOR Providers

EOR Pricing per Month per Employee

Full EOR Services Pricing per Month

As pricing is subject to change, we are listing prices as they stand in February 2025.

Hidden Charges Behind Employer of Record Fees

While it’s easy to focus on headline costs like monthly service fees or per-employee rates, many providers include additional charges that can significantly inflate your overall expenditure.

These hidden fees often may not be immediately obvious during initial discussions — which may include:

- EOR setup fees — one-time charge for establishing the partnership, setting up accounts, and onboarding employees.

- Refundable security deposit — required by some providers as a safeguard against non-payment or unexpected liabilities.

- Commission for bank transfers and withdrawals — spending associated with international transfers or currency conversions.

- Fees for premium or tailored features — charges for optional or advanced services.

- Country-specific legal fees — for navigating legal complexities in specific countries with stringent labor laws.

- Exit fees — charges for terminating the EOR agreement or for individual employee offboarding.

How to Avoid Hidden EOR Expenses

- Request full transparency. Ask for a detailed breakdown of fees, including potential hidden fees, in the initial proposal.

- Understand country-specific rates. Since fees often vary by country, clarify all these differences upfront.

- Negotiate fee caps. For recurring charges, such as bank transfer commissions or tailored services, try to establish a maximum cap.

- Scrutinize contract terms. Ensure exit fees and refund conditions for deposits are clearly defined to avoid disputes.

EOR Benefits: Do They Justify EOR Cost?

EORs deliver significant value — eliminating costly barriers to global expansion, protecting businesses from financial risks, and enabling efficient workforce management. In this section, we’ll review these cost-impacting benefits in more detail.

Cost-Related Advantages of EOR

Time Savings

Compliance Adherence

Scalability

Efficient Global Expansion

Simplified Employee Management

Access to Global Talent

While EOR services might appear to be expensive, the value they deliver often might outweigh the investment by driving operational efficiency and facilitating growth.

Assessing the budget-friendliness and other EOR benefits, consider this:

- Without an EOR, scaling globally requires the costly process of setting up and maintaining legal entities, which can range from $25,000 to $100,000 per country.

- With an EOR handling compliance, businesses protect themselves from pricey non-compliance risks, which are estimated to average $14.82 million.

- EOR’s ability to provide access to global hiring vs employing locally in high-paying regions is more efficient: for example, the annual salary of a mid-level software engineer in India is approximately 74% cheaper than in Austin, Texas.

- EORs, by handling local hiring logistics, save businesses the expenses of recruitment agencies and reduce time-to-hire, which can impact revenue generation.

Whether it’s avoiding entity setup fees, mitigating compliance penalties, or accessing affordable talent, EORs may justify their price — however, eventually, it all comes down to your specific business needs and goals. Check out a few use cases where they do so.

EOR In Action: Common Use Cases

Startups

GOALS

- Hire local developers to scale their product

- Quickly onboard talent to meet tight product development timelines

- Maintain operational focus without navigating complex labor laws

COST-EFFICIENCY

- Avoiding entity setup fees

- Reduced recruitment expenses

Small and Medium-Sized Enterprises

GOALS

- Quickly hire a small sales team to penetrate European markets

- Access local market expertise

- Scale operations incrementally based on market performance

COST-EFFICIENCY

- Fewer expenses by outsourcing compliance

- Efficiency from centralizing HR functions

Large Enterprises

GOALS

- Establish operations overseas to meet increased production demands

- Reduce labor costs by hiring in budget-friendly markets

- Ensure compliance with complex labor regulations in multiple countries

COST-EFFICIENCY

- Savings from avoiding entity setups

- Access to cost-efficient skilled labor

Tips for Evaluating the Cost of Employer of Record Services

Identifying an EOR provider that offers both affordability and value might not be an easy task for your business. However, with the right strategy, it’s possible to find the EOR partner that could ensure maximum ROI for your business.

Explore these key tips and strategies that can help you select an affordable-efficient EOR option for you.

EOR TIP #1

Beyond any EOR benefits, prioritize pricing transparency to avoid unexpected additional fees that can disrupt and diminish the service’s overall value.

To apply this effectively, take these actions:

- Opt for predictable Employer of Record service cost structures, choosing an EOR with transparent pricing models.

- Clarify currency conversion rates, along with compliance, offboarding, and other service fees to avoid surprises.

- Verify that pricing remains predictable when hiring in new regions or adding more employees.

- Ensure the provider offers tools to monitor and track expenses in real time.

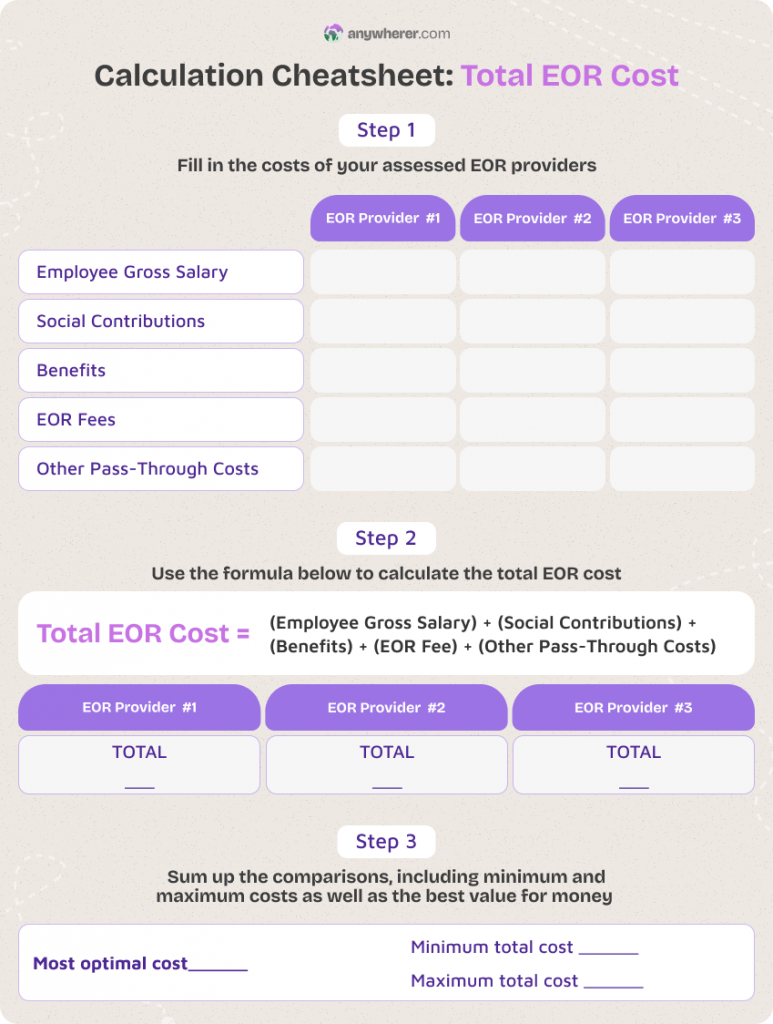

Check out the cheatsheet below highlighting the formula for assessing the total EOR cost that you could use during your assessment.

By applying this formula, you can ensure pricing transparency and gain a clear understanding of the total EOR costs. This, in turn, will allow for better comparison between platforms and a more accurate assessment.

EOR TIP #2

Low fees don’t guarantee lower costs — the overall expenses, including local taxes, social contributions, and benefits, vary significantly depending on the hiring country, as well as how well the EOR manages these costs.

It’s essential to go beyond surface pricing and dig deeper into how the platform structures its fees and expenses. Explore the table below showcasing an example of how seemingly cheaper platforms can result in a total cost that matches or even exceeds that of more expensive EOR providers.

Example: Proportional EOR Cost Comparison

| Cost Component | Platform A | Platform B | Comparison Insights |

|---|---|---|---|

| EOR Platform Fee | $50 | $500 | Platform A charges a significantly lower EOR fee compared to Platform B. |

| Employee Salary | $3,000 | $3,000 | Gross salary remains the same across platforms. |

| Social Contributions | $1,200 | $800 | Platform B optimizes employer contributions. (Potentially through better compliance management or a better understanding of local tax laws) |

| Benefits | $300 | $250 | Platform B’s expertise allows it to negotiate better benefit packages. |

| Total Monthly Cost | $4,550 | $4,550 | Despite the higher fee, Platform B delivers the same final cost while ensuring compliance. |

To avoid this cost-related misconception, we recommend the following:

- Calculate the total monthly cost, including salary, social contributions, benefits, and the platform fee altogether.

- Inquire whether the EOR provider has a proven track record of optimizing employer contributions in the hiring country.

- Determine if a platform with a higher fee provides additional benefits or extra services that could add greater value to your business.

EOR TIP #3

Look beyond immediate spending and focus on the long-term value they can bring to your business.

To leverage this tip, follow the steps:

- Compare the fees of Employer of Record services against establishing and maintaining legal entities.

- Assess whether the EOR can adapt to your growth plans.

- Ensure they handle diverse employment types (full-time, part-time, contractors).

- Analyze how quickly the EOR can support market entry and hiring in new regions.

Employer of Record Service Cost Assessment

To ensure you choose a provider that aligns with your goals and offers value for their services, it’s essential to ask the right questions.

Apply this list of inquiries to evaluate their capabilities, cost transparency, scalability, and ability to meet your business needs effectively.

FAQs on EOR Pricing

How much does an Employer of Record cost?

An Employer of Record cost per month, including all fees, might range from $200 to $2,000 per employee, depending on the region, services, and workforce size. Some providers charge a flat fee, while others use a percentage-based model (10–15% of salary). EORs eliminate the need for the high expenses associated with setting up local entities, making them a budget-friendly solution for global hiring, but it’s essential to clarify additional fees upfront.

How do Employer of Record costs compare to setting up a local entity?

Employer of Record fees are significantly lower than setting up a local entity. EORs eliminate the need for legal, tax, and compliance infrastructure, offering a budget-friendly alternative for businesses expanding internationally.

Is using an EOR more cost-effective than managing international hiring independently?

Yes, since independent international hiring requires navigating complex labor laws and tax systems, often resulting in higher administrative and legal costs without the assurance of compliance.

What are the cost implications of hiring in countries with complex labor laws?

Hiring in countries with complex labor laws can involve pricey compliance requirements: severance payments, union agreements, and frequent tax filings, to name a few. EORs are able to manage these intricacies, thus reducing the risk of legal disputes or penalties — all while saving businesses time and money.

What are the benefits of paying for EOR services despite the cost?

In many cases, EOR services justify their price. Among its many benefits, they can eliminate entity setup expenses, ensure compliance, streamline payroll, and grant access to global talent, to name a few. This way, they allow businesses to focus on growth without the burden of navigating international employment complexities.

Can EOR costs scale with business growth?

Yes, EORs are designed to scale with your business. Doing so, most providers offer flexible Employer of Record pricing structures — allowing you to add or reduce employees and expand into new markets without any significant upfront EOR costs. This scalability ensures predictable expenses as your workforce grows.

What happens if my business needs change – can I renegotiate fees with an EOR?

Many EOR providers allow businesses to renegotiate fees based on changes in workforce size, regions of operation, or service requirements. Yet, ensure discussing EOR provider’s flexibility beforehand during the contract negotiation phase.

How transparent are EOR providers about their pricing?

Reputable EOR providers offer clear, upfront pricing with detailed breakdowns of services and associated fees. It’s important to request information about hidden fees, such as onboarding, compliance updates, or termination fees, to ensure complete transparency.

Explore ways to test the cost efficiency of and other transformative benefits of EOR solutions.

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.