Introduction

Employer of Record providers play a crucial role in global hiring, reflecting shifts in regional workforce trends, market-specific challenges, and evolving hiring demands. Monitoring these hiring trends is essential for companies looking to scale efficiently, reduce risks, and stay competitive in the global talent market.

To better understand global hiring trends, the Anywherer Team conducted in-depth research and data analysis across the leading Employer of Record providers worldwide. This report explores key hiring hotspots, the impact of EORs on workforce expansion, and overall dynamics in global hiring.

Disclaimer: The data in this report reflects open roles listed by EOR companies for their own internal teams. This research is intended to highlight how EOR providers are expanding globally, where they are hiring, what roles they prioritize and how remote work is being adopted across their own operations.

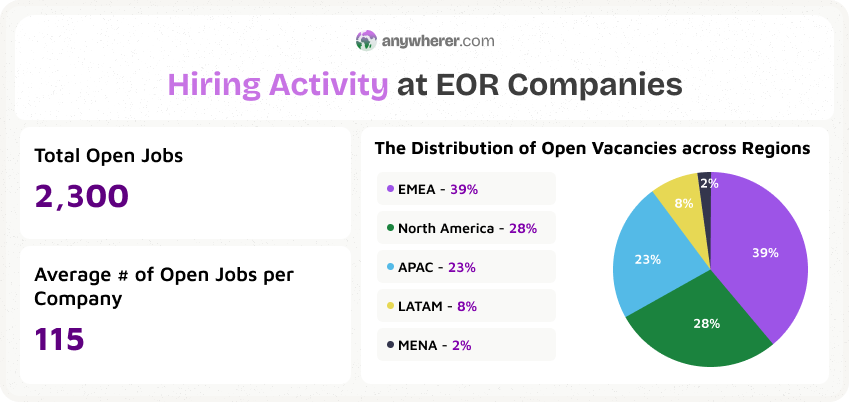

Current Landscape of Open Jobs by Top EOR Providers: Key Stats

Before diving into in-depth research, let’s explore some key trends from March 2025 indicating that the global EOR market continues to evolve. The statistics below highlight the overall current scope of the Employer of Record market, along with the main hiring regions.

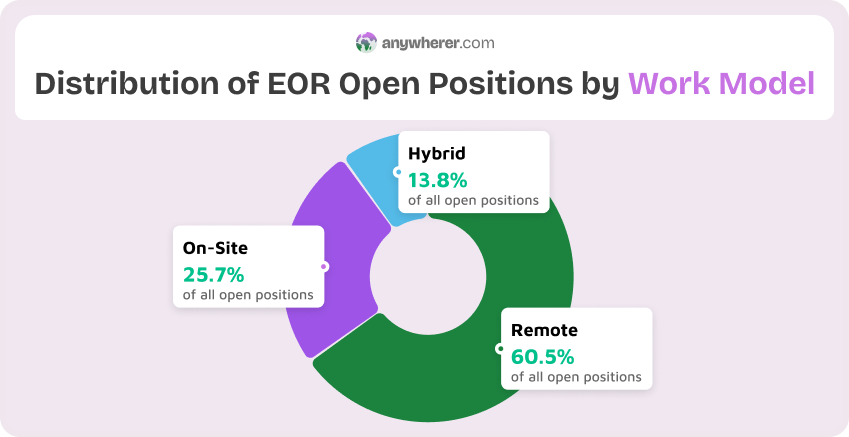

Remote vs On-Site: Which Wins?

Based on our data, the rise of remote work continues to reshape hiring patterns, but on-site and hybrid roles still play their part in the global hiring landscape.

Is There a Correlation Between the Work Model and a Hiring Location?

Our research revealed that European-headquartered EOR providers are more inclined towards remote work compared to the US-based ones. In EOR companies with Europe-based HQs, 100% offer a majority of remote positions. Among them, 80% have more than 90% of their roles as remote.

That said, some US-based EOR providers have a 100% remote job vacancies portfolio, but their proportion within the North America region is too small to significantly impact the overall statistics. In particular, for US-headquartered EOR providers, 50% of companies have between 85-100% of their jobs as remote-only. Of the remaining companies, 30% offer a majority of hybrid roles, while 20% prefer on-site vacancies.

EOR Providers Focused on Remote-Based Jobs in March 2025

The list below shows EOR providers that have 100% of their open jobs listed as remote, along with their top hiring locations. As seen, 3 out of 6 providers have EMEA as their leading hiring location – which might reflect the fact the EMEA region offers a strong remote-ready talent pool and favorable hiring infrastructure.

EOR Leaders of Remote Employment

Based on the gathered data, the following can be concluded: while EMEA is positioned as a strong region for remote hiring, it is US-based — not EMEA-headquartered — EOR companies that lead in the total number of open vacancies.

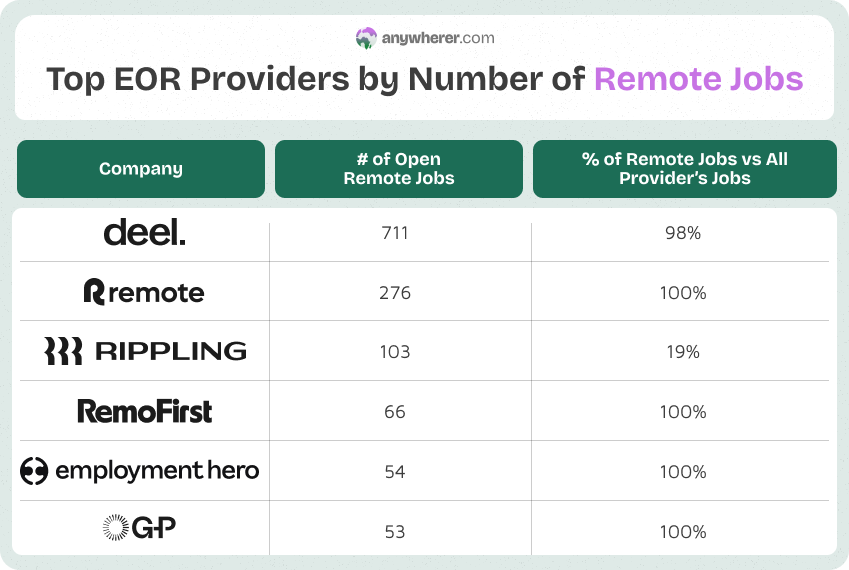

See the table below, which lists the top EOR providers with the highest number of remote-based jobs. While not all of these companies offer a majority of their roles as remote, their overall volume of positions makes them key players in the remote work landscape.

The table above reflects only the vacancies where the work type (remote, hybrid, or on-site) was specified. As a result, the total number of vacancies for some providers may be higher, but those without a stated work type are not included in this data.

EOR Leaders of On-Site Employment

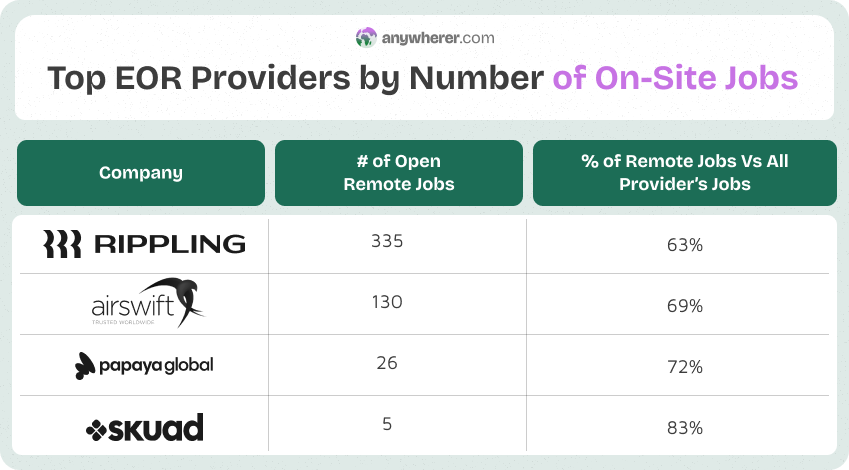

As for EOR providers that offer only on-site positions, no companies fall under this category. The list below highlights the top companies with both the highest number of on-site positions and the highest percentage of such roles relative to their total open vacancies.

EOR Leaders of Hybrid Employment

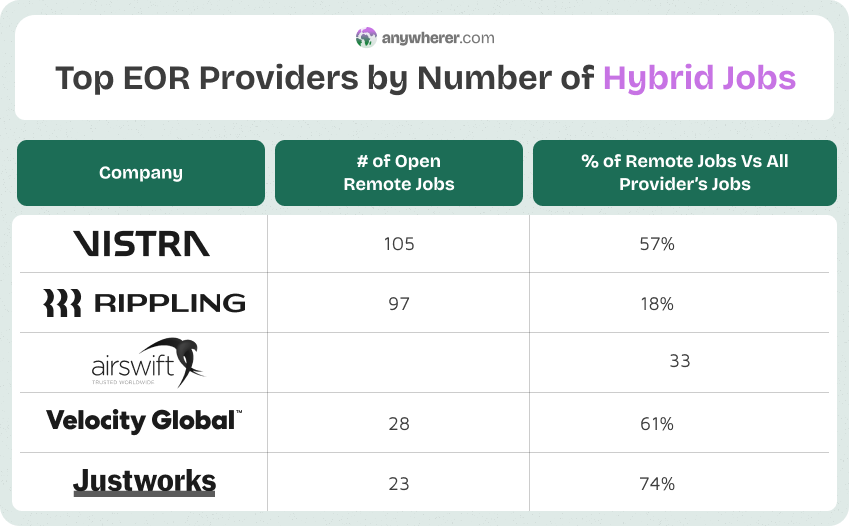

Similar to on-site work positions, the data shows there are no EOR providers offering 100% hybrid vacancies. See the list of hybrid employment leaders below.

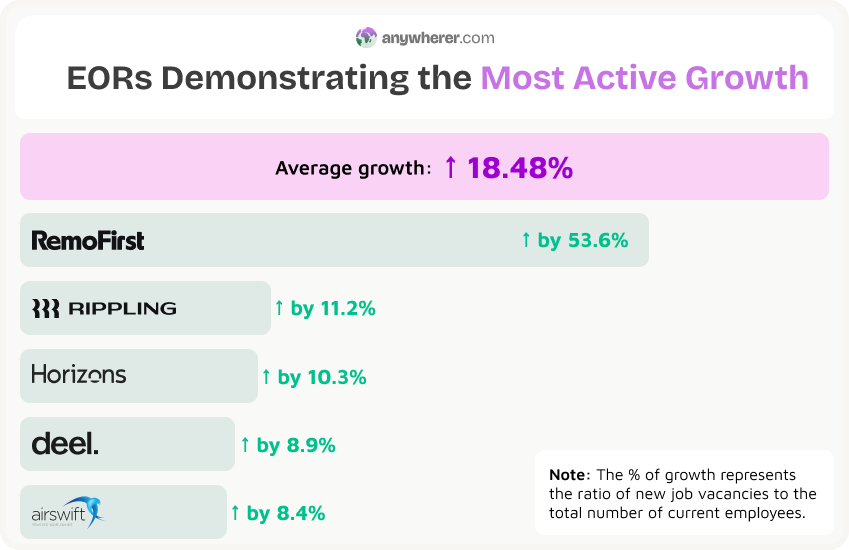

EOR Hiring Growth Leaders

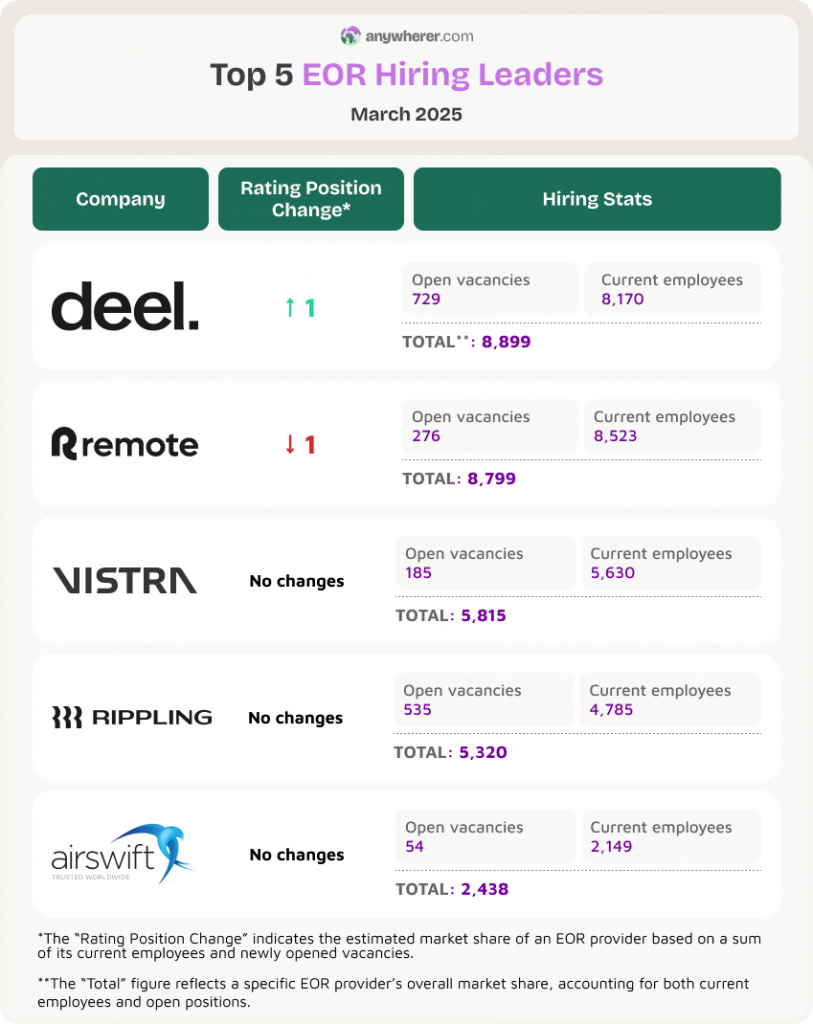

As the Employer of Record market continues to expand, certain providers stand out for their rapid hiring growth, shifting the landscape of EOR leaders. Explore the top EOR providers from March 2025 below.

Meanwhile, these figures don’t fully illustrate the broader context. When analyzing the growth of EOR providers, it’s important to consider not only those with the highest number of vacancies but also those with the largest percentage of open positions relative to their overall size. Looking at both these metrics provides a more nuanced understanding of hiring trends, distinguishing between large-scale hiring efforts and companies undergoing significant growth spurts. See such growth leaders listed below.

Which EOR Companies Are Growing the Most?

Based on the displayed data, the following is evident: while the companies with the highest number of open vacancies are the largest players in the market, the fastest-growing ones are not necessarily the biggest.

As mentioned above, three of the top five companies with the most open positions have around 200 in-house employees. This suggests that smaller but ambitious EOR companies are leading the way in growth.

Discovering EOR Hiring Hubs Worldwide

Zooming in on specific geographical regions and global hiring demands, distinct country-specific growth trends are emerging. These trends may be influenced by various factors, including economic conditions, labor market dynamics, regulatory environments, and others.

Check out the top hiring locations globally that are currently the most attractive for recruitment among the EOR providers.

Geo-Specific EOR Hiring Trends

In this section, we’ll present data-driven insights on specific geographical regions, including which types of EOR providers find them most attractive, which locations are the most and least popular, and other key observations.

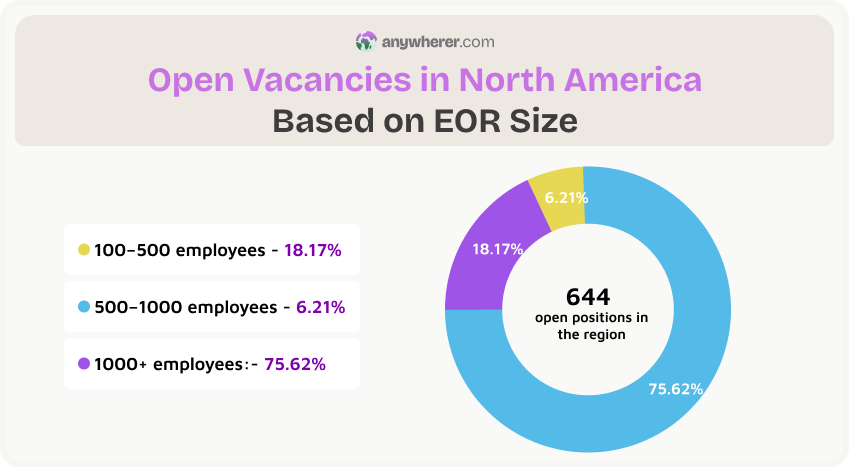

North America

North America shows a strong hiring activity, especially among large EOR enterprises, which account for 75.6% of NA’s total vacancies. This suggests that the region remains a central hub for EOR operations and that large-scale firms are aggressively expanding. Meanwhile, as the stats demonstrate, smaller businesses still contribute meaningfully to the growth of NA-based vacancies.

However, data shows that North America is not the leading hiring location for EOR enterprises. Despite having a strong share of enterprise-level vacancies relative to other business sizes, it contributes only 25.5% of all global openings from 1000+ employee companies — making it a major market but not a leading destination.

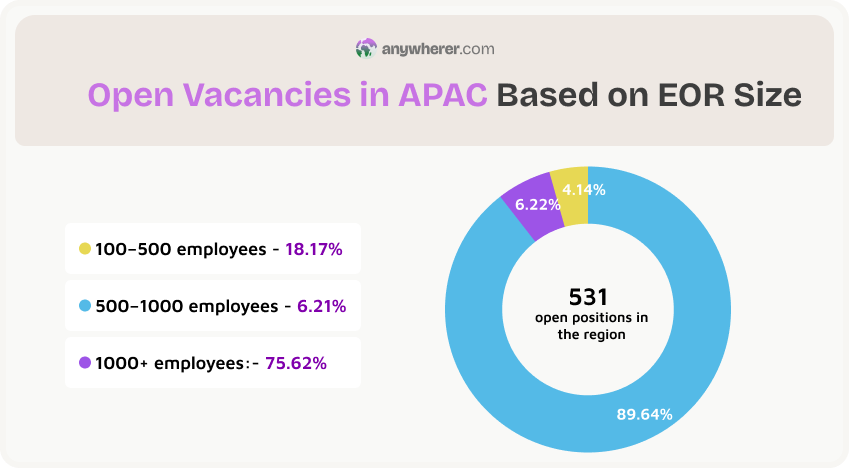

Asia-Pacific (APAC)

APAC shows strong enterprise-level hiring, with nearly 90% of vacancies coming from companies with 1000+ employees.

Large EOR providers also allocate a greater share of their vacancies to APAC: APAC-based roles make up 25% of all their openings, compared to just 11% on average for smaller businesses. This tendency suggests the region’s complex regulatory environments and diverse markets are more accessible to established companies with robust infrastructure.

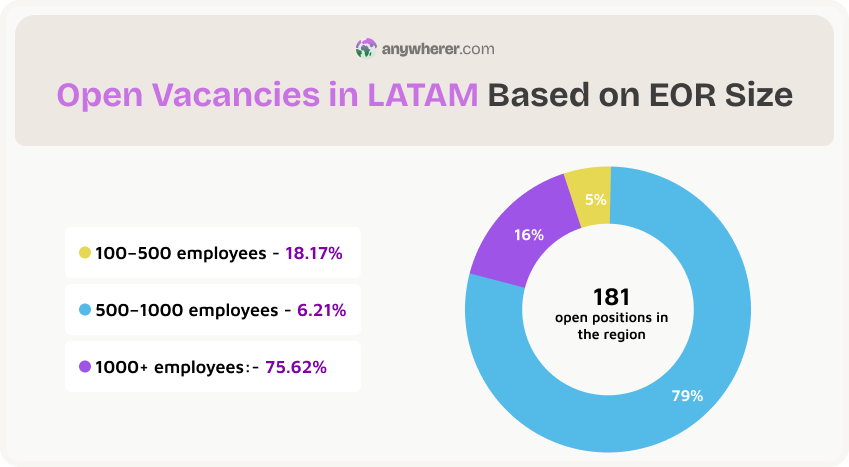

Latin America (LATAM)

Latin America is an emerging market for EOR growth, with enterprise-level companies leading hiring according to the total number of vacancies.

Meanwhile, when evaluating the share of region-based vacancies by business size, it’s clear that smaller companies (100–500 employees) have a slightly greater share of LATAM-based vacancies compared to their total openings. This indicates that smaller companies might be more open to exploring this emerging EOR market.

However, it needs to be noted that the total number of open roles is significantly lower than NA and EMEA, which suggests that it’s still early-stage for EOR firms and scaling remains measured.

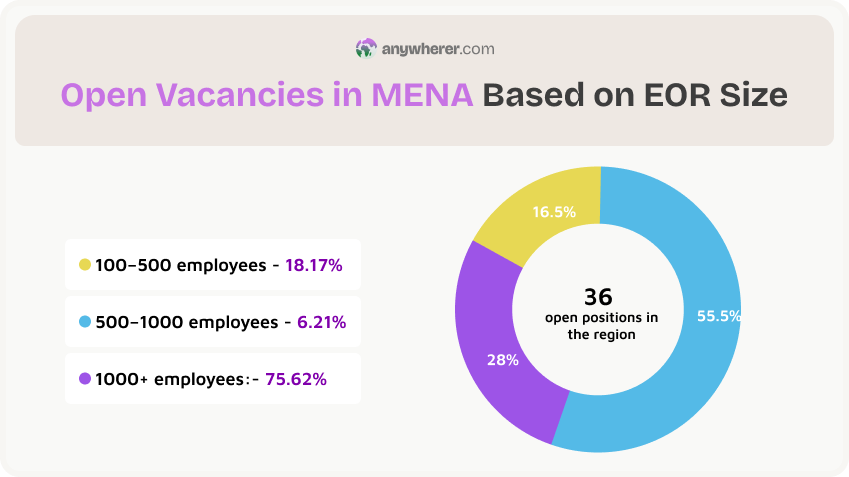

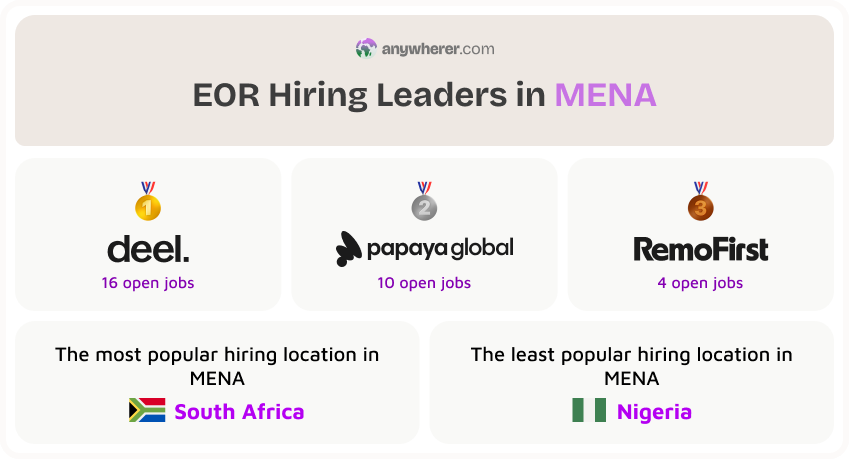

Middle East and North Africa (MENA)

MENA shows the lowest hiring activity across all business sizes, with only 36 total vacancies. While the demand is more evenly distributed across company sizes compared to other regions, enterprise-level EOR providers still hold more than half the market share, maintaining dominance in the region.

Interestingly, it is mid-sized companies that place the greatest relative focus on MENA, with 8.5% of their vacancies directed toward the region — compared to just 1–2% for other business sizes.

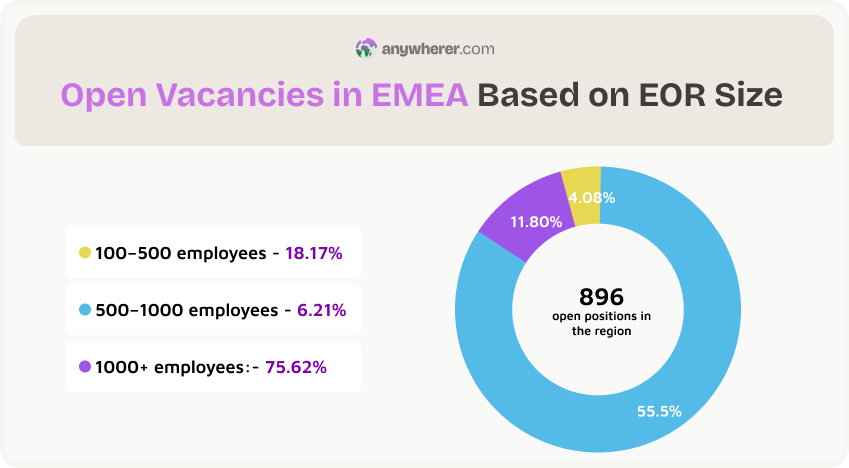

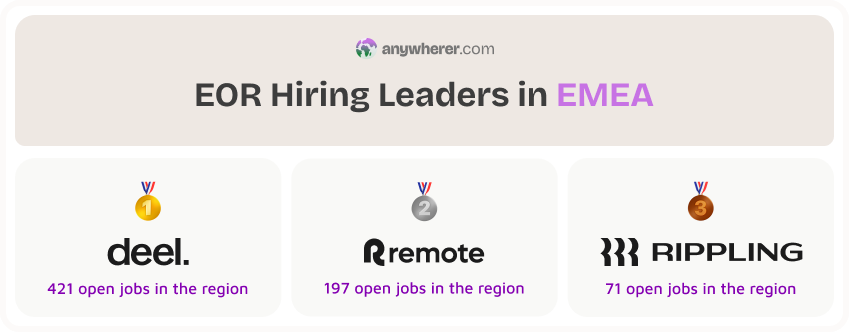

Europe, Middle East, and Africa (EMEA)

EMEA is the global hub for EOR hiring, responsible for an average of 39% of all vacancies worldwide across businesses of all sizes. Its balance across business sizes suggests EMEA is attractive for both established giants and scaling firms.

While big players dominate hiring in the region — 41% of their roles are EMEA-based — smaller and mid-sized companies are actively hiring too. This is evident from the proportion of their EMEA-based vacancies: 32% for companies with 500–1000 employees and 37% for smaller companies. Altogether, these numbers indicate a mature and scalable market.

As hiring trends continue to evolve, EMEA has emerged as a key region for EOR expansion. But what’s driving this surge in hiring? Is it simply a reflection of where companies are based, or are other factors at play? Let’s review some insights.

From Questions to Conclusions

Is there a correlation between the number of open positions and the number of companies EOR covers? — Our research did not show any correlation.

Is there a correlation between a company’s headquarters location and its growth tendency in EMEA? — Our research did not show any correlation.

Do companies with the largest number of employees in EMEA hire the most actively in EMEA? — Yes, our findings suggest a relationship between the two.

Our research shows that EOR providers are expanding in EMEA regardless of their home base. The data indicates that EMEA’s hiring boom is not necessarily driven by a provider’s location or total market coverage but rather by other factors. These may include business demand, workforce availability, and labor law complexities, all of which make EOR services essential.

Wrapping Up EOR Global Hiring Tendencies

Finalizing the research, key takeaways on EOR hiring trends include the following:

- EMEA leads globally in EOR hiring demand, accounting for 39% of all open vacancies across company sizes.

- Remote work remains the most common employment model, representing 60.5% of all job listings.

- U.S.-based EOR providers dominate remote-first hiring by the number of remote-based vacancies, but the highest share of companies offering 100% remote roles are headquartered in EMEA.

- Even though large EOR providers have the biggest number of vacancies, smaller EOR companies are driving the highest growth, with some showing vacancy growth rates of 50% or more relative to their current size.

Whether you’re a startup seeking compliant global hiring or an enterprise optimizing workforce distribution, these region-specific EOR trends can help you better understand the overall dynamics of global hiring.

Explore additional in-depth EOR insights and industry expertise to stay ahead in global hiring.

Disclaimer: Companies’ logos are used for editorial purposes only and remain the property of their respective owners. Use does not imply endorsement.

Yaryna is our lead writer with over 8 years of experience in crafting clear, compelling, and insightful content. Specializing in global employment and EOR solutions, she simplifies complex concepts to help businesses expand their remote teams with confidence. With a strong background working alongside diverse product and software teams, Yaryna brings a tech-savvy perspective to her writing, delivering both in-depth analysis and valuable insights.